Customer Grievance and Redressal at GVP

General issues / Complaints

End User specific (Through Merchants / Customers):

- Refund issues

- Transaction related issues

- General Queries

Merchants/Customers specific:

- Chargeback related issues

- Transaction related queries and issues

- Refund related explanations/issues

- Payment options activation/deactivation requests

- Settlement/Reports related

- Integration/Tech related issues and queries

- On-Boarding related issues and queries

Team handling complaints

Our teams undergo regular training to ensure that consumer’s queries and grievances are handled in an appropriate manner. They are encouraged to work in a manner which helps us in offering a first- time resolution and in turn build the consumer trust and confidence. This reflects in both the operations as well as the customer communications.

Complaint Registration:

Customers / Merchants can register their grievances through various channels, including:

Email: Customers can send an email to our dedicated customer support email address, provided on our website.

Phone: Customers can contact our customer support helpline, which is available during business hours.

Online Form: We offer an online complaint form on our website, where customers can submit their grievances.

Complaint Acknowledgement:

Once a complaint is received, we will acknowledge the complaint within 48 hours. The acknowledgement will include a unique complaint reference number, which the customer can use for future reference.

Investigation and Resolution:

We will initiate a thorough investigation into the customer's grievance. Our dedicated grievance resolution team will review the complaint and take appropriate actions to resolve the issue. This may involve contacting relevant parties, such as banks or merchants, to gather additional information if necessary.

Timely Resolution:

We are committed to resolving customer grievances in a timely manner. We aim to provide a resolution within Seven [7] business days from the date of complaint registration. However, complex cases may require more time for investigation, and we will keep the customer informed about any delays.

Communication and Updates:

Throughout the complaint resolution process, we will maintain regular communication with the customer. We will provide updates on the progress of the investigation and inform the customer about any additional information or documents required.

Escalation:

If a customer is not satisfied with the resolution provided, they can escalate their complaint. We have a designated escalation mechanism where the complaint will be reviewed by a senior management team member. The escalated complaint will be given priority, and efforts will be made to address it promptly.

Final Decision:

Once the investigation is complete, we will communicate the final decision to the customer. If the complaint is found valid, we will provide appropriate remedies or compensation as per our internal policies. If the complaint is not upheld, we will explain the reasons behind the decision to the customer.

Feedback and Continuous Improvement:

We value customer feedback and consider it essential for improving our services. After the complaint is resolved, we may request customers to provide feedback on their experience and suggestions for improvement. This feedback will be used to enhance our processes and address any shortcomings identified during the grievance resolution process.

Customer Grievance Handling Process:

- Receipt of Complaint: Customers can lodge complaints through various channels such as email, phone, or our website. The customer service team will acknowledge the complaint and provide a reference number for tracking purposes.

- Investigation: The customer service team will investigate the complaint to understand the issue and gather relevant information. If necessary, the team will seek assistance from other departments such as technical support, risk management, or compliance.

- Resolution: The customer service team will provide a resolution to the complaint within a reasonable time frame. The resolution may involve corrective action such as refund, chargeback, or other forms of compensation. The team will communicate the resolution to the customer and seek their acceptance.

- Escalation: If the customer is not satisfied with the resolution, they can escalate the complaint to the next level of management. The escalation process should be clearly communicated to the customer, and their complaint should be handled with priority and urgency.

- Documentation: All complaints and their resolution should be documented in a complaint register for tracking and analysis purposes. The customer service team should periodically review the register and identify trends and areas for improvement.

Turn Around Time (TAT)

The Company will also have dedicated resources who will be responsible to ensure that all complaints raised by the merchants are addressed and closed as per stipulated TAT. Typical, TAT followed to resolve any queries/ complaints will be as follows:

| Types of Queries | TAT |

|---|---|

| Basic | Up to 12 working hours |

| Complex | 12 to 18 working hours |

| Tech related | 24 to 48 working hours |

Customer Redressal Mechanisms:

- Customer Service: Customers can contact our customer service team through various channels such as phone, email, or chat. The team should be well-trained and equipped to handle customer queries and complaints in a professional and courteous manner.

- Nodal Officer: We have designated a nodal officer for grievance redressal as per the regulations. The nodal officer will handle complaints that are not resolved satisfactorily by the customer service team. The nodal officer's contact details should be prominently displayed on our website and other communication channels.

- Ombudsman: Customers can also approach the ombudsman appointed by the regulatory authority for redressal of grievances. We will cooperate with the ombudsman in resolving complaints and provide all necessary information and assistance.

Escalation Matrix

| Levels | Escalation | TAT |

|---|---|---|

|

Level-0 |

Support Executive Email : support@arthpay.com |

48 business hours |

|

Level-1 |

Head Operations Email : onboarding@arthpay.com |

7 business days |

|

Level–2 |

Nodal Officer Email : nodal@arthpay.com |

21 business days |

|

Level-3 |

Business Head Email : grievance@arthpay.com |

30 business days |

Conclusion:

We are committed to providing our customers with a reliable and secure payment aggregator service. Our customer grievance and redressal procedures are designed to ensure that customers have a hassle-free experience and their complaints are resolved in a timely and effective manner. All employees involved in customer service and complaint handling must familiarize themselves with these procedures and comply with them at all times.

Merchant Onboarding Policy at GVP

1. Introduction:

Our Merchant On-Boarding Process is simple, secure, and robust to ensure thorough assessment, evaluation, and judgment of our prospective partner merchants for availing our services.

We have an independent Risk Intelligence Control team that finalizes the merchant onboarding process. This team will work independently making their own assessments and evaluations after receiving individual sets of data that is collected from the Merchants through merchant onboarding form. This team is responsible for doing assessment on the given Merchant application and activating the Merchant account, simultaneously mitigating any probable bias and discard any ‘Objectionable Merchants’ that are either (or have in the past) carrying out business operations that do not comply and adhere to the enforced laws of the land or conduct businesses that have a high degree of risk that could possibly lead to cheating or defrauding people and invariably leading to any legal disputes.

Our assessment and evaluation processes followed have been diligently drafted primarily on the guidelines and rules framed by the RBI (vide Notification DPSS.CO.PD.No.1810/02.14.008/2019-20 Dt. 17/03/2020), advice and counsel of our banking partners and renowned consultants, prevailing industry best practices and our own zeal to provide our Merchants and Customers a safe, trusted, reliable and a secure platform to allow exchange of payments across. These assessments, evaluations and processes are updated from time to time as per the regulatory guidelines formulated and enforced.

2. Scope

The merchant onboarding policy’s scope is broadly covered as per the following:

- FDSL shall undertake background and antecedent check of the merchants, to ensure that such merchants do not have any mala fide intention of duping customers, do not sell fake / counterfeit / prohibited products,

- Merchant’s website shall clearly indicate the terms and conditions of the service and timeline for processing returns and refunds.

- In case FDSL is maintaining an account-based relationship with the merchant, the KYC guidelines of RBI, in their “Master Direction – Know Your Customer (KYC) Directions” updated from time to time, shall apply mutatis mutandis to Parties.

- Payment Application Security: Payment applications shall be developed as per PA-DSS guidelines and complied with as required. FDSL shall review PCI-DSS compliance status as part of merchant onboarding process

- FDSL shall be responsible to check Payment Card Industry-Data Security Standard (PCI-DSS) and Payment Application-Data Security Standard (PA-DSS) compliance of the infrastructure of the merchants on-boarded. FDSL needs to ensure compliance of the infrastructure of the merchants to security standards like PCI-DSS and PA-DSS, as applicable

- Merchant site shall not save customer card and such related data, a security audit of the merchant may be carried out to check compliance, as and when required.

- FDSL shall ensure that the Merchants thus onboarded comply with the following regulations and /or industry standards.

- Provisions of Prevention of Money Laundering Act, 2002 and Rules framed thereunder, as amended from time to time.

- Not storing customer card credentials and such related data and customer card authentication details within the database or the server accessed by the merchant. Merchants are not allowed to store payment data irrespective of their being PCI-DSS compliant or otherwise. They shall, however, be allowed to store limited data for the purpose of transaction tracking; for which, the required limited information may be stored in compliance with the applicable standards.

- Data Sovereignty: FDSL shall take preventive measures to ensure that a Merchant does not store data in infrastructure that belongs to jurisdictions which may be physically located outside India. Appropriate controls shall be considered to prevent unauthorized access to the data.

- FDSL shall have a proper agreement in place for on-boarding.

- FDSL shall ensure that no transaction or account-based relationship is undertaken without following the Customer Due Diligence (CDD) procedure as per RBI’s Master Directions on KYC, as updated from time to time.

- Agreement with merchants shall have provision for security / privacy of customer FDSL’s agreement with merchants shall include compliance to PA-DSS and incident reporting obligations.

- FDSL shall obtain periodic security assessment reports either based on the risk assessment (large or small merchants) and / or at the time of renewal of contracts.

- FDSL shall undertake comprehensive security assessment during merchant onboarding process to ensure that RBI’s minimal baseline security controls are adhered to by the merchants.

- FDSL shall also ensure that the Merchant complies with the terms and conditions of the Acquiring Banks it has entered into agreement with, for onboarding merchants.

3. Merchant Onboarding

The FDSL understands that merchant onboarding is one of the key facets while undertaking business operation, as it covers critical aspects viz. evaluation of merchant’s business, Know Your Customer (KYC) of merchants, risk assessment, etc. to mitigate any potential risk. The FDSL will leverage upon the Merchant Management System (MMS), which will act as a critical tool to run the merchant acquiring program. The MMS tool will enable the FDSL to undertake necessary risk- assessment and KYC process of merchants (including Ultimate Beneficial Owner).

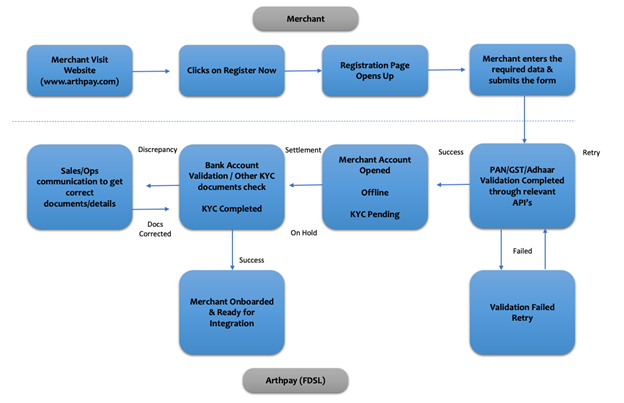

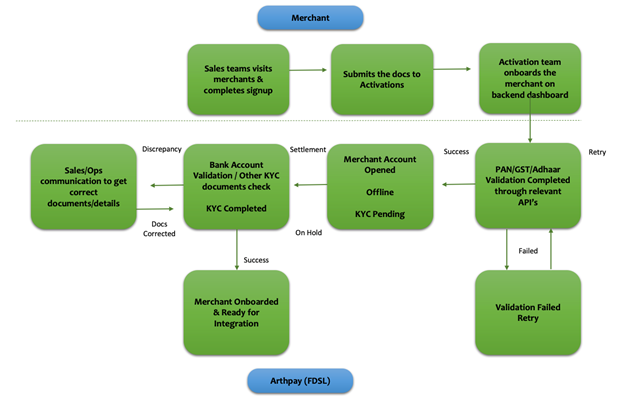

3.1 Onboarding Platforms:

The FDSL will onboard the merchants via any of the following ways:

Onboarding through sales or activation teams – Where merchants will be onboarded through Operations Team

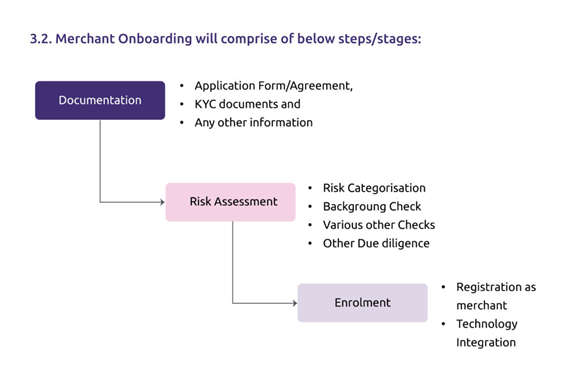

3.2 Merchant onboarding will comprise of below steps / stages:

The FDSL has adequate systems in place for merchant onboarding that helps them to collect and process the necessary details. The FDSL also has an internal list of certain banned businesses as annexed after this process, in order to evade onboarding those merchants which are unacceptable or pertains to high-risk industries. Step by step process envisaged for merchant onboarding in both the processes is encapsulated below:

- Merchant will be onboarded in 2 methods:

- Merchant to be sourced by the sales teams

- Or partners will be onboarded directly in the Merchant Management System.

- Sales team will collect all the required documents and submit it to Sales Support Ops resource

- Sales Ops will scrutinize the documents received, and complete applications will be handed over to Operation team for onboarding

- To begin with this process will be manual and once the system is ready, the flow of documents and info will be through the MMS.

- In both flows, Merchant or relevant teams will complete the below stated mandatory fields

- Company Registered Name

- Doing Business Name

- Type of Business

- Website Address

- Business Address

- Contact Details (Email Address & Mobile Number)

- Business PAN and adhaar number

- Signing Authority PAN number

- Signing Authority Aadhaar number

- Bank Account Details (For settlement)

- Bank Name

- Bank Account Number

- IFSC Code

- Branch Name

- Account Type

- The Company will obtain the merchant's business registered name and address, business profile, website address, contact details (email & mobile number), PAN and GST details, signing authority PAN and Aadhaar, bank account details (for settlement), etc.

- Once the above details are obtained, the Company will trigger relevant API’s to validate the details via respective issuing authorities the PAN, GST details, Aadhaar and bank account details provided by the company has partnered with service provider’s to instantly verify PAN / GST / Aadhaar (As per relevant guidelines) & Bank account via their API’s ; Services Consumed: Pan Validation, Aadhaar Validation, GST Validation). Instant validation at field level – As the merchant enters the relevant details, the validation API is triggered and validates the data point immediately. The benefit here is that the entire loop of repeating at the end of the exercise of completing the form in case of any errors is reduced

- Correct – We activate the merchant and proceed ahead for merchant to upload below docs for backend verification

- Cancelled Cheque

- Document copies (Refer KYC Documents below)

- Note – This to constitute page 2 of the online application form

- In-correct – Merchant will be prompted to re-attempt this point again post checking the details at their end

- Post activation, Merchant can now download API keys from Merchant dashboard console and initiate integration

- Settlement will be on HOLD

- Simultaneously, Operations Team will also undertake background / antecedent checks on the merchants. Furthermore, a third-party check of all Directors, Promoters, Shareholders, and top management of the Prospective Merchant is conducted against government sanctioned lists, enforcement lists, credible diverse media, public court records, geography specific research, third party contributors, client requests, etc.

- On successful verification in backend by ops team, team will complete checks in the Merchant Management System, on the documents uploaded by the merchant and activate settlements for the In case of any discrepancy in the information/ details provided by the merchant, it will be flagged off to sales SPOC’s or merchant SPOC’s via email or SMS engine, so that they can confirm and re-check the details, and needful can be done to correct the documents, and settlement will be left on HOLD till discrepancies are sorted

- Merchant will now be fully activated for accepting payment

- On completion of this step, merchant will be shown a landing page in his console stating “Thank you for completing the process! We will get back to you on your registered email address on further steps. We thank you for your association.”

- Operations Team will assess and complete risk management checks through an internal risk assessment method which helps in categorizing merchants as High, Medium, or Low basis the type of business and background verification results.

- Further basis the category of the merchants, the Company will decide whether any collaterals or security would be required from such merchant while onboarding the merchants on the platform

- FDSL will also screen merchants against a database of restricted category of merchants as per card network/ association, which will be maintained and updated from time to time.

- On an ongoing basis, the FDSL will update the risk category of the merchant basis the transaction history and the Chargeback Threshold Ratio (CTR)

Note – This will constitute page 1 of the online application

3.3 Merchant prerequisites & Documents Workflow

There is a maker and checker/approver involved wherein all details entered at the time of onboarding/Sign up by a maker/Merchant is validated by the checker.

3.3.1 Maker/Self Sign up – Onboarding

All documents and prerequisite information are entered along with required validation at the time of Maker onboarding and merchant self-sign up

Maker/Merchant sign up portal will not be able to submit the application in case of incomplete application

3.3.2 Checker/Approver – Onboarding

Checker validates all prerequisite information along with the documents uploaded with validation at the time of onboarding to either approve/reject the merchant.

3.4 KYC Table

| KYC Documents | ||

|---|---|---|

| Particulars | Mandatory / Optional | Descriptions |

| Cancelled Cheque | Mandatory | Cancelled cheque of the merchant’s business account under which the settlements are to be made. |

| PAN Card | Mandatory | A copy of PAN card should be signed by authorized signatory and stamped with merchant’s business (company) seal. |

| Government Issued Business Certificate | Mandatory | A copy of Registration Certificate and MOA, AOA should be signed by authorised signatory and stamped with merchant’s business (company) seal. |

| Documents of the signing authority | Mandatory | Copy of Identity Proof and Address proof to be self- attested & stamped with merchant’s business (company) seal.PAN, Passport, Aadhaar, Voters ID Card. |

| Business Address Proof | Mandatory | Electricity Bill, Landline Bill, Copy of Rent Agreement. |

| Financials | Optional | Financials of last 2 financial years |

| Bank Statement | Optional | Last 3 months bank statement |

Turn Around Time (TAT)

- Activation – Instant on submission and validation of Merchant will be activated on test mode and will be able to integrate with our gateway.

- Settlement – This will be done on verification of KYC docs, TAT for the same will be 4 hours post KYC validation. Upon completion of the onboarding process the merchant will be provided access to the Merchant Panel which consists of the following features:

- Dashboard – Summarized view of Transactions/ Settlements/ Modes of Transactions

- Transactions – Details of individual transactions triggered through Arthpay Simplified Digital Payments Solution

- Settlement – Settlement information regarding amount settled to merchant date

- Refunds – Information regarding all the refunds for transactions triggered through the Arthpay Simplified Digital Payments Solutions

- Chargeback – Workflow and view of all chargebacks

- Web Terminal – Capability to generate payment links to be sent to consumers via SMS or Email

- User Management – User Access Management for users of Merchants

- Notifications – Notifications for payment statuses

3.5 Merchant Onboarding Flow(Indicative)

4. Restricted businesses

Following is a list of categories which are banned for accepting payments online. If any of the merchants is found accepting payments on the following categories, then it would be heavily penalized along with the termination of services.

- Adult goods and services which includes pornography and other sexually suggestive materials (including literature, imagery, and other media); escort or prostitution services; Website access and/or website memberships of pornography or illegal sites

- Alcohol which includes alcohol or alcoholic beverages such as beer, liquor, wine, or champagne

- Body parts which include organs or other body

- Bulk marketing tools which include email lists, software, or other products enabling unsolicited email messages (spam).

- Cable descramblers and black boxes which includes devices intended to obtain cable and satellite signals for free.

- Child pornography which includes pornographic materials involving minors

- Copyright unlocking devices which include mod chips or other devices designed to circumvent copyright protection.

- Copyrighted media which includes unauthorized copies of books, music, movies, and other licensed or protected materials; Copyrighted software which includes unauthorized copies of software, video games and other licensed or protected materials, including OEM or bundled

- Counterfeit and unauthorized goods which includes replicas or imitations of designer goods; items without a celebrity endorsement that would normally require such an association; fake autographs, counterfeit stamps, and other potentially unauthorized goods.

- Drugs and drug paraphernalia which includes illegal drugs and drug accessories, including herbal drugs like salvia and magic mushrooms.

- Drug test circumvention aids which include drug cleansing shakes, urine test additives, and related items.

- Endangered species which includes plants, animals, or other organisms (including product derivatives) in danger of extinction.

- Gambling which includes lottery tickets, sports bets, memberships/ enrolment in online gambling sites, and related content. Skill based games can be allowed on case-to-case basis.

- Government IDs or documents which includes fake IDs, passports, diplomas, and noble

- Hacking and cracking materials which includes manuals, how-to guides, information, or equipment enabling illegal access to software, servers, website, or other protected property.

- Illegal goods which include materials, products, or information promoting illegal goods or enabling illegal acts.

- Miracle cures which include unsubstantiated cures, remedies or other items marketed as quick health fixes.

- Offensive goods which include literature, products or other materials that: Defame or slander any person or groups of people based on race, ethnicity, national origin, religion, sex, or other

- Encourage or incite violent acts; or Promote intolerance or

- Offensive goods, crime which includes crime scene photos or items, such as personal belongings, associated with criminals.

- Pyrotechnic devices, combustibles, corrosives, and hazardous materials which includes explosives and related goods; toxic, flammable, and radioactive materials and substances.

- Regulated goods which include air bags; batteries containing mercury; Freon or similar substances/refrigerants; chemical/industrial solvents; government uniforms; car titles; license plates; police badges and law enforcement equipment; lock-picking devices; pesticides; postage meters; recalled items; slot machines; surveillance equipment; goods regulated by government or other agency specifications.

- Securities which include government bonds or related financial

- Tobacco and cigarettes which includes cigarettes, cigars, chewing tobacco, and related

- Traffic devices which include radar detectors/jammers, license plate covers, traffic signal changers, and related products.

- Weapons which include firearms, ammunition, knives, brass knuckles, gun parts, and other

- Wholesale currency which includes discounted currencies or currency

- Live animals or hides/skins/teeth, nails, and other parts of animals.

- Multi-level marketing collection

- Matrix sites or sites using a matrix scheme

- Work-at-home approach and/or work-at-home

- Drop-shipped

- Any product or service which is not in compliance with all applicable laws and regulations whether federal, state, local or international, including the laws of India.

- The User providing services that have the potential of casting the payment gateway facilitators in a poor light and/or that may be prone to buy and deny attitude of the cardholders when billed (e.g., adult material/ mature content/escort services/ friend finders) and thus leading to chargeback and fraud losses.

- Businesses or website that operate within the scope of laws which are not absolutely clear or are ambiguous in nature (e.g., web-based telephony, website supplying medicines or controlled substances, website that promise online matchmaking).

- Businesses out rightly banned by law (e.g., betting & gambling/ publications or content that is likely to be interpreted by the authorities as leading to moral turpitude or decadence or incite caste/communal tensions, lotteries/sweepstakes & games of chance.

- The User who deals in intangible goods/ services (e.g., software download/ health/ beauty Products), and businesses involved in pyramid marketing schemes or get-rich-quick schemes.

- Any other product or service, which in the sole opinion of either the Acquiring Bank, is detrimental to the image and interests of either of them / both, as communicated by either of them/ both to the User from time to This shall be without prejudice to any other terms & conditions mentioned in these Terms of Use.

- Mailing

- Virtual currency, cryptocurrency, prohibited investments for commercial gain or credits that can be monetized, re-sold, or converted to physical or digital goods or services or otherwise exit the virtual world.

- Money laundering

- Bidding/auction

- Activities prohibited by the Telecom Regulatory Authority of India; and

- Any other activities prohibited by applicable

5. Risk Assessment (RA) and treatment (RT)

5.1 Introduction

Risk assessment is a key integral process at the time of merchant onboarding. It is used to mitigate merchant credit and fraud risk that will ultimately result in losses and write offs to Company’s due to merchant failure or fraudulent activity resulting in chargebacks, which cannot be recovered, from the merchant in which case Company’s is left to carry the full financial responsibility.

5.2 Rationale for Risk Assessment – Why We do RA:

- Identify risk factors that have the potential to create losses to

- Proactively analyze and evaluate the risk associated with any fraudulent

- Determine appropriate ways to eliminate or minimize the risk

5.3 Risk Assessment Checks:

- Veto Check: Veto checks are performed only if merchant business model over their platform (Website/App) seems Positive as per LOB guidelines. Below checks are considered to perform Veto checks

- Business/Legal Name Mismatch:If legal name of entity and that displayed on website mismatches, we seek for further clarification/ relationship documents between the two entities

- Pricing in Dollar/Other Currencies (INR not listed):If website is dealing only in NON-INR currencies, we don’t allow and seek further clarification on requirement of PG services

- Fraud Merchant List Check: This is maintained by (Visa / Master /Rupay) and proposed to be auto validated through Operations from backend at regular intervals.

- Website Redirection: If website is redirecting to a different website for purchase or Payments, we seek clarification on requirement of PG Web/App not live. If web/app is not live or throwing some error, we don’t allow and inform the business team to take up with merchant further

- Incorrect web/app URL: If shared URL is incorrect and not functional, we don’t allow and inform the business team to take up with merchant further

- Login Credential Required: Few websites provide login-based access. If we are able to sign up at our end, we will sign up ourselves and complete the If we are unable to sign up. we don’t allow and inform the business team to take up with merchant further.

- While there can be one or multiple issues observed during Veto checks, we don’t block the merchant Onboarding journey and continue to the next steps.

- Line of Business check: Line of Business is checked to ascertain if merchant is dealing in acceptable businesses or not, depend on their website/business, model status would be as mentioned below:

- Positive: These are acceptable businesses

- Negative: These are non-acceptable businesses as per the guidelines

- Can’t be decided:These businesses are subject to further verification of business model. Additional information or documents are sought here. *Business Model must be clearly defined while ascertaining LOB of the merchant. Model must accurately define the use of PG on the merchant website/application. Purpose of PG must be clearly stated in detail.

- Mandatory parameters (MP)check: Post veto activity, we perform Mandatory checks for Enabling CC/DC If merchant website/URL have the required policy as per banking rules & regulations. (need to confirm these) These need to be available mandatorily to process CC/DC operation. *If MP is incomplete, it cannot be processed further.

- About us: Verify brand identity, business model, line of business and

- Terms and condition: Verify Governing Law clause in which jurisdiction the legal terms of the Company’s lie (if required), Termination clause w.r.t. customer/User, legal name of merchant, Intellectual Property clause, Limit Liability w.r.t User/Customer.

- Refund & Cancellations Policy: Verify Refund policy offered by merchant (Returns/ Refunds OR replacements OR No refund no exchange), Applicable Policy TAT (Days till policy remains active for services/products as per merchant business model), Mode of Refund, the time till when the merchant is going to accept the cancellations and through which all channels.

- Privacy Policy: Privacy Policy should be according to the jurisdiction of India or their state in addition, from where merchant is doing his business, Customer/user Information Collection, Use of Information, Third Party Disclosure, Information Protection, Rights of Users, Cookies policy and notification of Changes

- Check Out page/ Payment flow: Verify Add to cart option availability, payment flow and Checkout button or payment method redirection

- Contact Us: Verify Organization’s legal name, Indian registered or current/operating address along with PIN code, Company/organization’s contact number, communication Email ID of organization

- Commercials Check: This check is needed for the enterprise level merchants. RA users need to validate merchant’s commercials as per the updated benchmark sheet for respective banking industry. RA users need to select approve/reject/approval required for all the line as per the Commercials which are below the benchmark rates would need an approval from the respective business HOD.

6. Onboarding Risk Rules

The following are the onboarding Risk Rules:

| Sr. No. | Use Cases | Rules | Validation |

|---|---|---|---|

| 1 | Velocity Checks | Transaction Type Limit Per Transaction Limit per MID | Mode of payment used Amount set per transactionMax amount set per MID |

| 2 | Routing Checks | Bin based routingHigh / Medium / Low risk-based routingCard type based routing Merchant category based routing | |

| 3 | Realtime transaction monitoring | Alerts on all velocity checks and Routing check to the internal team | Breach of limit set |

| 4 | MCC Validation | SET MCC | |

| 5 | Risk Classification of Merchants | Low / Medium / High |

6.1 Velocity Checks workflow

System should have the capability to configure various velocity checks to ensure transaction are monitored and scrutinized right at the inception.

Capability to configure alerts for internal users as and when the below velocity checks are breached

- Maximum number of tries per card

- Maximum transaction per card per day

- Maximum no of transactions per user per day

- Maximum daily transaction limit per MID

- Per transaction amount in case of high-risk merchant

On alerts the respective team should be provided with the details of the merchant for corrective action

- Merchant Name

- Merchant Contact Details

- Transaction Amount

- Date & time of the transaction

User should be able to take an action basis the process and accordingly block/Hold or cancel the transaction and same to be informed to both merchants and internal users.

6.2 Routing Checks workflow

System should have the capability to configure various velocity checks to ensure transaction are monitored and scrutinized right at the inception.

Capability to configure alerts for internal users as and when the below Routing checks are breached

- Bin based routing

- High / Medium / Low risk-based routing

- Card type-based routing

- Merchant category based routing

On alerts the respective team should be provided with the details of the merchant for corrective action

- Merchant Name

- Merchant Contact Details

- Transaction Amount

- Date & time of the transaction

User should be able to take an action basis the process and accordingly block/Hold or cancel the settlement/transactions and same to be informed to both merchants and internal users.

6.3 Realtime transaction monitoring workflow

Enabling the Risk team to monitor transactions in real time basis so that expected frauds can be identified and alerts can be sent to the respective team for corrective action

System will run at regular intervals and send alerts to respective team with the below data points

- Real time transaction monitoring console at merchant & at transaction level

- Real time suspected fraud alerts via mail to risk team as well as alerts on console

- Blocking or holding of transactions basis the severity of subsection

- Re-course action on the suspected transactions to be executed in the module itself

User should be able to take an action basis the process and accordingly block/Hold or cancel the settlement/transactions and same to be informed to both merchants and internal users.

6.4 MCC Validation workflow

- Ops team user should have role-based access to view this functionality

- MCC validations are done basis the details provide by the merchant at the time of

- Request for MID/TID are raised with the respective partner banks/Aggregators

- MID/TID received from the partner banks/Aggregator are configured for the merchant at the time of onboarding

6.5 Risk Classification of Merchants workflow

Risk classification of the merchants are done basis the predefined SOP and the banned category list maintained and updated time to time by the ops team.

Merchants are classified as High/Medium or low risk merchants at the time of onboarding

RA score calculation model is solely dependent on merchant’s website and merchant legal entity where we validate and verify both through online sources. There are 12 parameters for website review and 7 parameters for legal entity review. Final calculated score based on weighted averages of different parameters define the credit limit offered to the merchants. This parameter will be shared with business

RA agents need to capture all merchant related policy screenshot, key product screenshot & homepage, payment page of merchant website once all the Risk assessment will be done as evidence (This is mandatory & all the screenshots need to be uploaded on the platform itself [OE & SF]).

7.1 Business Specific Documentation Requirement:

Complete a Merchant Agreement with each merchant, must meet Association minimum requirements, which pertain to: honoring cards, Prohibitions, Cardholder account information security etc.

7.2 Legal Department

Prepares and approves Merchant Agreement: Add additional provisions dealing with (where applicable)

- amending the merchant agreement

- chargeback conditions

- fees and charges

- freezing funds

- merchant liability

- terminating the agreement

- Policy which requires to have a clause that indemnifies FDSL from Issuer losses related to information security compromises where appropriate and legally permitted.

Prohibit Merchants from adding sub merchants unless approved by Underwriting and Risk Management.

7.3 Additional Documents:

Every application must be signed and submitted with site survey with photographs.

Site inspection report for high-risk merchant types and known fraud locations (by geography), unless waiver is allowed in local product program) As per Risk assessment process, Risk agent may seek business specific document, which should be provided in electronic or hardcopy form.

Banks might seek few additional documents for certain merchants. Eg. Financial statements which should adhere to the following guidelines:

- Financial statements should include 1- or 2-years’ balance sheet, 1- or 2-years’ income statement (Profit and Loss) and any accompanying notes.

- For applicants in business less than 2 years, draft financial results or a business plan should be obtained.

- Business turnover to be verified through the last 6 months’ bank statements. Only Current Account statements are acceptable and the legal name or DBA (Doing Business as) of the merchant should reflect in the account statement.

Account Screened Under Risk Assessment Checks: a) All parent accounts/ sub-accounts passed through documents QC having a valid website/App URL (On SF& OE).

7.4 Additional Validation Checks by Risk team:

Merchant dealing in Retails & Shopping category or requesting for International Gateways need to pass through few additional checks created by Risk team (Risk Ops). Few validation checks performed by Risk Ops are as below:

Business location – Verify if the location belongs to popular fraud merchant zones.

Product sold – Determine if the product/service pricing are at par with market pricing or available with some lucrative offers. Delivery timeframe and conditions – To determine the potential risk with respect to Delivery method and timing. Privacy Statement – Review privacy policy. It should mention that confidential customer details would not be shared.

8. Moderate Risk Businesses & Unacceptable LOB

- Merchants under these categories would be decided on a case-to-case basis depending upon the profile of the customer. In such cases, additional documentation maybe required as well as certain business approvals maybe required. Negative LOB Update: Work from Home /MLM identified/seems to be duping schemes are not allowed & are considered as negative LOB, other WFH scheme where attractive /forgery/unrealistic monetary offers are not provided -are

- To define in detail with For ex: Crowd Funding /NGO /Online Gaming

- Ayurveda Merchants: Specific Guidelines to be followed as per constitution of the merchant.

9. Roles and Responsibilities

- Every employee within the onboarding team is responsible for ensuring compliance of the clauses of the Risk Policy as per organization standard risk policy. Any deviation in judgment is to be approved by approval authority & will be dependent on the role& experience of the RA agent. Approval authorities will be assigned and approved jointly by the Head of Department and the pertinent manager of Regular training and assistance will be provided to relevant staff to assist with risk management.

- Any non-regulatory norm not defined in existing policy shall have to be approved by

- Any deviation regarding a regulatory norm to be approved by Legal/ Compliance and respective Head of Department.

- Any exception for merchant validation (non-regulatory) to be approved by Business Head/Head of Department. Any waiver in document requirement for merchant on boarding and validation to be approved by Business Head/ Head of Risk

- All agents within team will follow a predefined hierarchy based on their approval authority. The risk team’s initial review carries with it the responsibility for approving a prospective merchant and, if necessary, forward on the application for further approval to the required authority.

- List of all Onboarding teams /stakeholder: (To be Provided by Business Team)

- Exceptional/ Additional Scenarios at Risk Assessment stage:

- International Acceptance: Can be given only after approval from Risk Ops Rates also needs to be above benchmark.

- Big Brands entering Indian market/ launching new products detailed RA can be relaxed for certain

- If there are less than 5 unique products on the website/APP, onboard them only with certain Limits (for example 100 K limits irrespective of their LOB).

- Negative Line of Business (LOB) check for Company’s PG and Wallet services

- While on boarding the merchants for offering Wallet and / or PG services, Company’s team will observe the following guidelines:

- Unqualified / Negative Businesses – Merchants under these categories cannot be on boarded by the Please do not solicit these accounts as they are outside of policy guidelines both due to regulatory reasons as well as due to business/strategic reasons.

- Negative Businesses due to compliance reasons– Merchant under these categories can be on boarded after discussion with Risk / compliance team.

10. Addendum Process

Purpose of Addendum:

To record: Web /App URL Addition, Web/App URL change, Revised Rates/Commercial Change, Product inclusion / deletion

Web /App URL Addition: If merchant is already live with us on any Platform (Web/App) and merchant requires PG services on other Web/App URL with same legal entity then, Merchant needs to create a sub- account & raise the request of Addition of URL to sales.

Business team analyses the website and completes the checks on risk assessment and forwards the same to Risk Team for approval from Head of Risk.

Revised Rates/Commercial Change: If merchant wants to change the commercial or add any instruments the same needs to be done post approval of Head of Business with a copy marked / forwarded to the Risk Team.

The above Policy to reviewed periodically and updated versions to be uploaded basis the trends / changes approved by the Board

Refund and Chargebacks at GVP

Purpose:

The purpose of this policy is to establish guidelines for handling refunds and chargebacks for We to ensure compliance with applicable laws and regulations, protect our customers and merchants, and maintain a strong reputation for our services.

Scope:

This policy applies to all customers, merchants, and employees involved in the refund and chargeback process for We.

Policy:

Refunds:

- 1.1. The customer requests a refund from the merchant due to reasons such as the non-delivery of goods or poor service quality. Merchants can initiate refunds against transactions with us either via the website or via APIs. We shall provide merchants with the ability to process refunds for their customers in accordance with their own policies.

- 1.2. Merchants shall be responsible for all refunds to their customers, and we shall not be liable for any merchant’s failure to provide refunds to customers.

- 1.3. We may provide assistance to merchants in processing refunds, including issuing refunds on their behalf in certain circumstances.

- 1.4. We shall comply with all applicable laws and regulations related to refunds, including any refund policies of card networks and other payment providers.

- 1.5 We act only as a mediator between the customer and the banks.

Chargebacks:

- 2.1. A chargeback occurs when a customer disputes a transaction and requests a refund from their bank or credit card issuer.

- 2.2. Card networks and regulated entities such as National Payments Corporation of India (NPCI) provide the rights to the cardholder/ consumer to claim a chargeback for various reasons such as Fraud transactions; Product/ services not delivered; Defective product or services are delivered; Duplicate payments/ double debits; etc.

- 2.3. The timeline(s) for raising such dispute may vary from card association to card association as per their policy which is posted or made available on their website. Every dispute raised carries a reason also referred to as reason code, which is defined by card networks.

- 2.4. We shall comply with all applicable laws and regulations related to chargebacks, including any chargeback policies of card networks and other payment providers.

- 2.5. Merchants shall be responsible for resolving chargebacks and shall have access to its chargeback management tools to assist in the process.

- 2.6. We shall provide assistance to merchants in responding to chargebacks, including providing information related to the transaction and working with card networks and other payment providers to resolve disputes.

- 2.7. We shall comply with all chargeback deadlines set by card networks and other payment providers.

- 2.8. We shall charge a chargeback fee to merchants for each chargeback that occurs. The fee will be in accordance with its fee schedule and will be deducted from the merchant’s account balance.

Fraudulent Transactions:

- 3.1. We shall use fraud detection tools to prevent fraudulent transactions from occurring.

- 3.2. In the event of a fraudulent transaction, it shall work with the merchant to prevent further fraud and take appropriate action to recover any lost funds.

- 3.3. If a chargeback occurs as a result of a fraudulent transaction, We shall assist the merchant in providing information to the relevant authorities and card networks to resolve the dispute.

Procedure:

Refunds:

- 4.1. The merchant shall be responsible for issuing refunds to their customers for any transactions processed through us.

- 4.2. If a customer requests a refund and the merchant is unable or unwilling to process the refund, the customer may escalate the request to us.

- 4.3. The customer or merchant must submit a refund request with the payment details and reason for the refund.

- 4.4. Once the merchant makes a refund request (either on Customer’s request or at its own), we will check if the request meets its eligibility criteria, accept the request and then forward this information to the respective acquiring banks and other banking institutions via APIs.

- 4.5. If the refund request meets eligibility criteria, the refund team shall initiate the refund process and notify the merchant or the Customer, whoever has initiated the refund or escalation.

- 4.6. If the refund request does not meet eligibility criteria, the refund team shall reject the refund request and notify the merchant or the customer, whoever has initiated the refund or escalation..

- 4.7. Given the number of entities involved and their different processes to handle refunds, refunds may normally take 5-10 working days to credit to the customer’s account. The timeline is different for different payment modes.

- 4.8. Refunds will be credited to the original source account only.

Chargebacks:

- 5.1. If a customer disputes a transaction processed through us, the merchant will be notified of the dispute and given an opportunity to provide evidence to defend the transaction.

- 5.2. If the merchant is unable to provide sufficient evidence to defend the transaction, the customer will be issued a chargeback.

- 5.3. The chargeback team will review the chargeback and any evidence provided by the merchant.

- 5.4. If the chargeback is found to be valid, the chargeback team will initiate the chargeback process and notify the merchant.

- 5.5. If the chargeback is found to be invalid, the chargeback team will reject the chargeback and notify the customer.

- 5.6. The customer has 120 days (or such other time as communicated by the Card network or issuer bank from time to time)from the date of transaction to raise a chargeback. The chargeback resolution however, is subject to the presentment and completion of the arbitration of the matter.

- 5.7 First level of Chargeback: If the Customer presents a chargeback claim to their issuing bank, the notification is then sent to the merchant for collection of valid supporting documents or proof such as proof of delivery or service utilisation to defend the claim. The case is decided in favour of or against the merchant based on the sufficiency of the supporting documents or proofs.

- 5.8. If a Customer disputes the validity of the supporting documents or proofs presented by the merchant, the chargeback goes to the pre-arbitration phase and the issuing bank, at its discretion and best judgement, asks for additional documents from the merchant. Pre-arbitration level attracts a processing fee imposed by the Card Networks and/or penalties.

- 5.9. If the issuer disputes the merchant's second presentment of documents or proofs, it leads to arbitration. Merchant should ensure the documents presented at this stage should be satisfactory for the chargeback to be decided in favour of the merchant. At this stage, the losing party bears an arbitration fee along with processing fees.

Failed Transactions:

- 6.1. Failed Transactions are the transactions which have not been fully completed due to any reason not attributable to the customer such as failure in communication links, non-availability of cash in an ATM, time-out of sessions, etc. Failed transactions shall also include the credits which could not be effected to the beneficiary account on account of lack of full information or lack of proper information and delay in initiating a reversal transaction.

- 6.2. For such transactions, we shall comply with the turn around time for refund as prescribed in the RBI Notification on Harmonisation of Turnaround Time (TAT) and customer compensation for failed transactions using authorised Payment Systems, vide DPSS.CO.PD No.629/02.01.014/2019-20, dated September 20, 2019. RBI Notification can be accessed here.

Other Terms:

- 7.1. All refunds are made to the original method of payment unless agreed otherwise by the customer to credit to some other alternate mode.

- 7.2. Credits towards reversed transactions (where funds are received by us) and refund transactions shall be routed back through escrow account.

- 7.3. The refund and chargeback teams shall ensure that all refunds and chargebacks are processed within the required timeframe.

- 7.4. The refund and chargeback teams shall maintain accurate and up-to-date records of all refund and chargeback requests and actions taken.

- 7.5. The refund and chargeback teams shall work together to identify trends or issues related to refunds and chargebacks and take appropriate action to address them.

Enforcement:

Any employee found to be in violation of this SOP may be subject to disciplinary action, up to and including termination.

Review:

This SOP shall be reviewed and updated as necessary to ensure compliance with changes in applicable laws and regulations, industry best practices, and changes to its services.